In the the high plains of Torrington, one of Wyoming’s best kept secrets is going to have a hard time remaining in the shadows for much longer, and the exponential growth they are experiencing is coming at exactly the right time.

When Wyoming Ethanol closed in Torrington in the fall of 2015, most could see the writing on the wall. The economics of using corn to produce fuel additive based ethanol was a losing proposition, even with steep government subsidies. Add in the Western Sugar beet plant closure and an irrigation canal collapse in 2019 and you have the makings of some very difficult times for a small community reliant on agriculture for survival.

Through the pandemic in 2020, a handful of entrepreneurs began working with Goshen Economic Development to begin processing ethanol once again, but this time for consumption in the form of bulk spirits. Over the last six months, EthanolUS and its subsidiaries, LIBEX (barrel aged whiskey), Free Brands (bottled well spirits), and The Cannery (canned ready-to-drink beverages) have been processing thousands of gallons of spirits for the U.S. beverage market and rapidly growing international markets.

EthanolUS CEO, Ray Digilio has been keenly aware of the growing market and identified Torrington as the ideal location for their business model. “At this point, there is not a producer in the U.S. who is accomplishing the price to quality that we are bringing to the market. The proximity of inputs from the southeast Wyoming ag economy, strategic partnerships, and the vertical nature of our business model is giving us a massive competitive advantage in this rapidly growing market,” Digilio said.

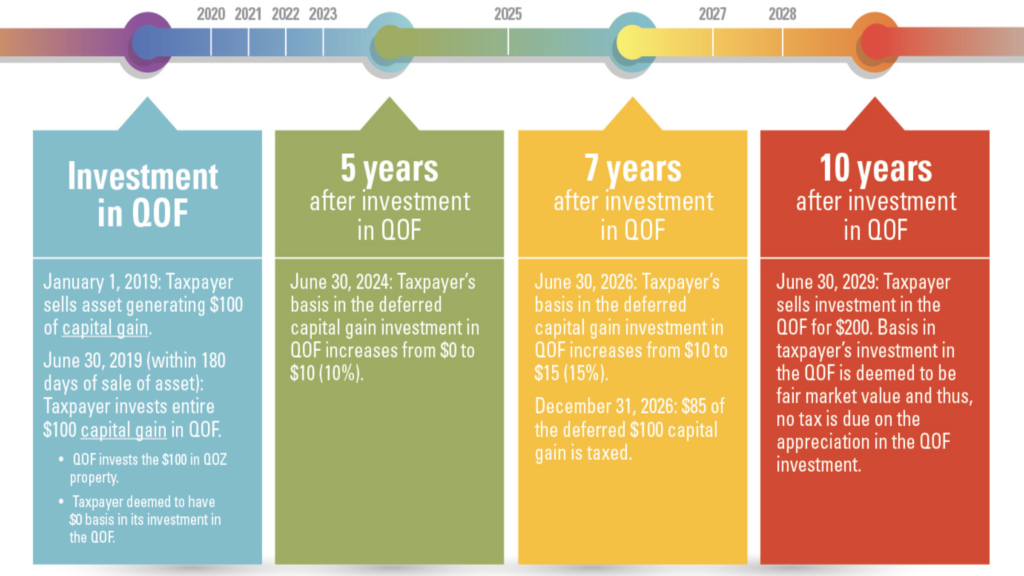

Digilio is a Double Gold award winning Master Distiller by trade and has cut his teeth with some of the largest and most successful spirits companies in the world. In Wyoming he has been building his founding team with local experts in agriculture and operations, running alongside a strong finance and marketing team. And ideally for the founders and investors, Torrington also happens to be situated in an Opportunity Zone (a tax haven for astute investors seeking shelter from capital gains). Investors who are seeing the company’s growth and potential are starting to line up.

Chief Marketing Officer of EthanolUS and LIBEX investor, PJ Treide explained the Opportunity Zone best, “Many asset classes are getting pretty frothy. Real estate, the stock market, cryptocurrency, and other asset classes are at or near all-time highs. An opportunity zone investment into LIBEX barrel aged whiskey right now, as one example, gives an investor the advantage of deferred capital gains on the sale of a winning investment and 100% tax free capital gains on the sale of the secondary investment down the road ( barrel aged whiskey). The opportunity zone investment was created to benefit the underlying community where the business is located and also greatly benefits the investor.” Treide said.

Investing in bulk spirits or barrel aged whiskey as an asset class is new to most investors, but is something that tends to do well no matter what the rest of the economy is doing. Eric McCormick, the EthanolUS COO and Co-Founder said, “whiskey consumption is rising at about 8% annually in the U.S. and 11% globally and is creating a literal bottleneck for distillers, large and small, many who cannot keep up with demand. Our barrel aged whiskey will be sold to these distillers to help meet that growing demand.”

The Torrington operation is also supplying bulk gin, rum, and vodka to small and large producers across the country and has its sights set on the massive global market, especially for aged whiskey. And McCormick put it simply, “all of that means opportunity and jobs here in Torrington, all in a new, diversified and exciting market for our state.”

Along with the added jobs comes the building of new facilities and that is where the team at Goshen Economic Development came knocking. As a part of a longer term agreement, EthanolUS bought a commercial lot in the Cold Springs Business Park in return for an additional gifted lot and the first right of refusal on several more for the aged whiskey facility expansion.

The company will be breaking ground on its next production facility and its first of several rick houses (whiskey barrel aging buildings) this fall. They will be closing their first two LIBEX whiskey bond funds (#1 – $1,000,000 and #2 – $1,000,000+) at the end of July and will produce and store several thousand barrels of whiskey that they will sell into the bulk market at 6 months, 2 years, and 5 years. Thousands of barrels of production and several new buildings in Torrington will require the company to hire quickly to meet demand.

Investors are excited about the double digit annual returns of the whiskey fund, McCormick said. “We expect to return 12-14% annually on investment for our LIBEX investors over the next five years. That return may be greater depending on how much penetration we can make into international markets and with the launch of our own retail Free Brands in late 2021 and with contract partners like Tina’s. The key is rolling our stocks every six months for profit and pre-selling the stocks to a market that simply can’t keep up. This is a win-win for Torrington, for Wyoming, for our investors, and for our company.”

“I love Torrington,” said Digilio. “Our company has been reliant on the area’s proximity to rail, interstate transport, agricultural inputs, a very hard working demographic, a local community college, supportive Torrington residents, and an ideal climate. We are very excited to be part of this community and have had nothing but supportive feedback from everyone we have met,” he added.

As the company continues to expand its footprint and growth in Torrington, they have recently begun to hit some important milestones and that means they are starting to get noticed. Governor, Mark Gordon and University of Wyoming President, Ed Seidel visited the production facility for a tour last week and met with EthanolUS leadership. Diversification, education, and job creation were on everyone’s mind as Wyoming continues to look for alternative revenue sources and economic diversification.

“I think our state’s leadership was impressed by our vision and initial growth”, said Digilio, “but I think they will be pleasantly surprised when they see the thousands of whiskey barrels stacked in Torrington by this winter and as they start to watch the tankers and totes of vodka, rum and gin roll out of Torrington.”

As we stood in the business park reviewing their building timeline and business plans, we sampled several of their products, and it became very clear that Torrington, Wyoming was going to be the home of a new and very important player in the bulk and aged spirits market.

We will be following up on this story this fall and tracking the company’s growth into the future. For more information on EthanolUS, please visit their website at www.ethanolUS.com, or for investors interested in the LIBEX whiskey bonds, please see the summary below, visit www.LIBEX.com or send an email to info@libex.com.